Factors that should be considered when making decisions include the company’s financial position, Cash Flow, profitability, and business strategy. Accountants use the information to make decisions by analyzing data and trends to make informed decisions to help the company achieve its goals. For U.S. companies, the monetary unit assumption allows accountants to express a company’s wide-ranging assets as dollar amounts.

Do you already work with a financial advisor?

Further, it is assumed that the U.S. dollar does not lose its purchasing power over time. Because of this, the accountant combines the $10,000 spent on land in 1980 with the $300,000 spent on a similar adjacent parcel of land in 2023. The result is that the company’s balance sheet will report the combined cost of two parcels at $310,000. The accounting principles quiz is one of many of our online quizzes which can be used to test your knowledge of double entry bookkeeping, discover another at the links below. When making decisions in accounting, it is essential to consider all relevant factors.

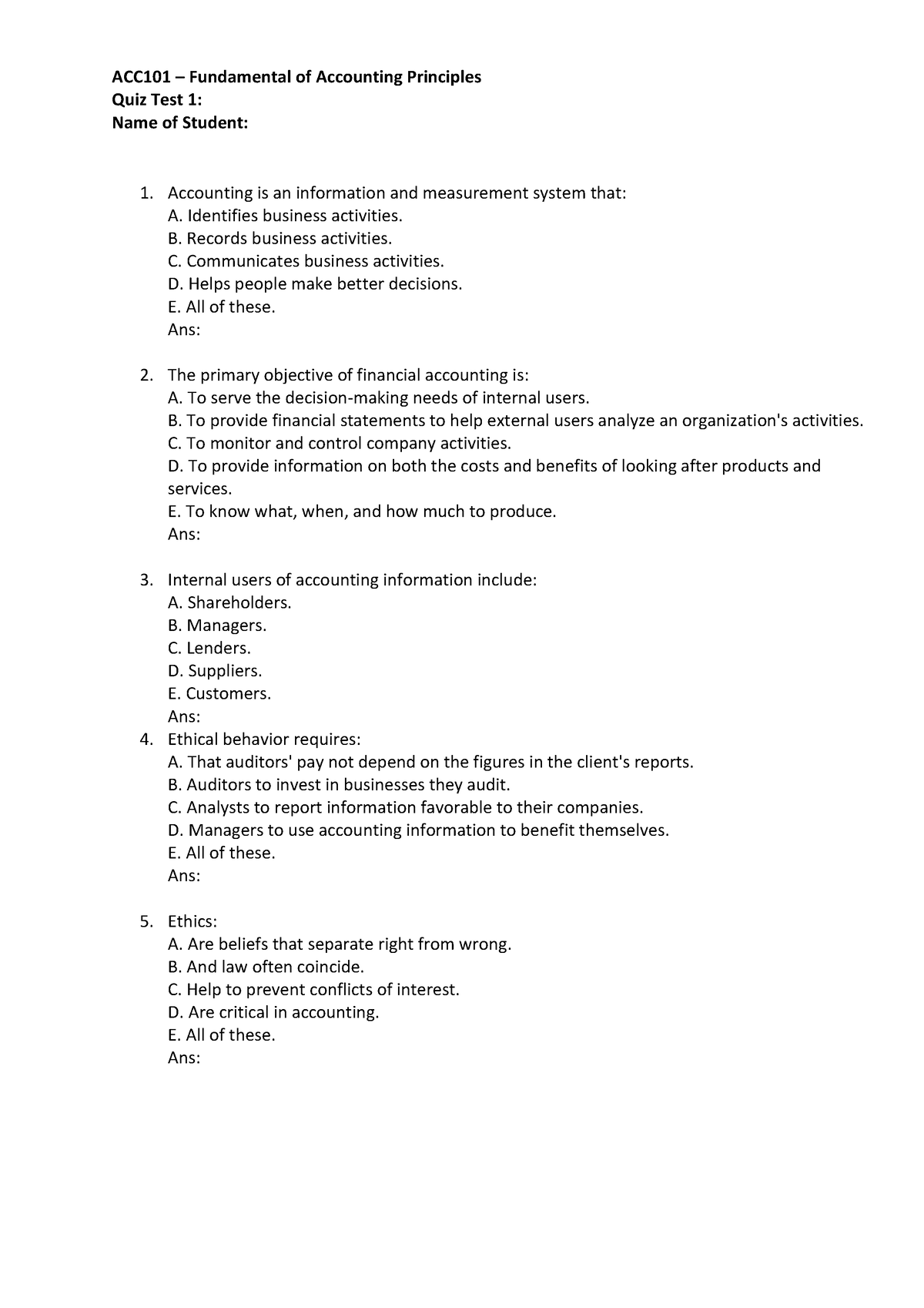

Accounting Principles Multiple Choice Questions

Our Explanation of Accounting Principles provides you with clear and concise descriptions of the basic underlying guidelines of accounting. You will see how the accounting principles affect the balance sheet and income statement. Take our basic rules for claiming a dependent on your tax return to check out your knowledge of the accounting assumptions and concepts used in double entry bookkeeping. You can read up on accounting principles in this post, but the best practice is actually working through accounting quiz questions. You see, basic accounting principles can be confusing, but they don’t have to be. If you want to find out how to quickly and easily solve these accounting problems, check out our Pass Accounting Class Resources.

- Our Explanation of Accounting Principles provides you with clear and concise descriptions of the basic underlying guidelines of accounting.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- If the company is not considered to be a going concern (meaning the company will not be able to continue in business), it must be disclosed, and liquidation values become the relevant amounts.

- So, how did you score on the accounting principles practice test above?

- Finance Strategists has an advertising relationship with some of the companies included on this website.

Main Financial Statements

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Recording expenses and revenues in the same period in which they occur. Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses!

For example, if an insurance company receives $12,000 on Dec 28, 2023 to provide insurance protection for the year 2024, the insurance company will report $1,000 of revenue in each of the 12 months in the year 2024. This graded 20-question test measures your understanding of the topic Accounting Principles. Discover which concepts you need to study further and enhance your long-term retention. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

If the revenues come from a secondary activity, they are considered to be nonoperating revenues. For example, interest earned by a manufacturer on its investments is a nonoperating revenue. Interest earned by a bank is considered to be part of operating revenues. Materiality also allows for a mid-size company to report the amounts on its financial statements to the nearest thousand dollars. If neither of the above is logical, expenses are reported in the accounting period that the expenses occur.

Comparability means that the user is able to compare the financial statements of one company to those of another company in the same industry. Comparability is enhanced by requiring the use of generally accepted accounting principles. The full disclosure principle requires a company to provide sufficient information so that an intelligent user can make an informed decision.

This is also a useful resource for employers to examine the technical knowledge of the candidates during an accounting or finance interview. The accounting guideline that permits the violation of another accounting guideline if the amount is insignificant. For example, a profitable company with several million dollars of sales is likely to expense immediately a $200 printer instead of depreciating the printer over its useful life.

Sobre o Autor

0 Comentários